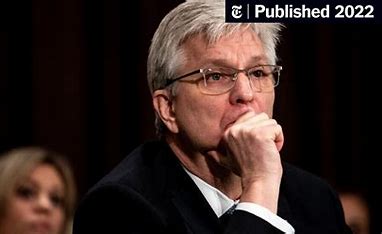

Fed’s Waller says slowing inflation led him to support big cut

Washington, DC, September 21, 2024 – US Federal Reserve Board of Governors member Christopher Waller said the recent slowdown in the inflation rate was the key factor in his support for a large cut in interest rates, a decision that could mark a major shift in the country’s monetary policy. Waller, known for his traditionally aggressive approach in fighting inflation, surprised many by indicating his support for a significant reduction, which has generated mixed reactions in economic circles.

Waller said the steady decline in inflation over the past few months was a decisive factor in his rethinking of his stance. “We’ve seen a moderation in prices, and that gives us room to take bolder action on interest rates,” Waller said in a speech at the annual economic policy conference in Washington. “My focus has always been on protecting price stability, but now that we’re seeing inflation cool, it’s the right time to look at other tools to maintain economic growth.”

Inflation slows

In August, US year-on-year inflation stood at 3.2%, down sharply from the peaks of 9.1% reached in June 2022. The decline has been attributed mainly to stabilizing oil prices, a reduction in supply chain bottlenecks, and lower demand for goods, all of which have eased pressure on prices. Despite fears that inflation would remain stubbornly high, recent data has shown that the Fed’s measures are starting to have an effect.

Waller stressed that while inflation remains a concern, the long-term risks of maintaining a tight monetary policy stance outweigh the benefits in the current environment. “It’s not just about bringing inflation down to a manageable level, but also about making sure that the economy continues to expand,” he explained. In this regard, Waller is aligned with other members of the council who have expressed the need to adapt to the evolution of recent economic data.

Impact of rate cuts

Waller’s support for an aggressive interest rate cut represents a significant shift from his stance, which in the past has been characterized by a tougher approach to inflation. This new direction, however, reflects growing pressure to balance economic growth priorities with price control. According to several analysts, the Fed could be considering a cut of as much as 75 basis points, a decision that would inject liquidity into the economy and reduce borrowing costs for businesses and consumers.

Interest rate cuts have several expected effects on the economy. First, they tend to encourage consumer spending and business investment, as borrowing costs are reduced. This could give a boost to sectors such as housing, automobiles and consumption in general. Second, companies would see less pressure on their balance sheets, which could lead to an expansion of productive activity.

Also read: Global Compact Banknote Sorters Market

However, there are risks involved as well. Cutting too quickly or too sharply could trigger an inflationary surge, especially if the labor market remains robust and wages continue to rise. Waller, mindful of these risks, stressed that the Fed is prepared to adjust its stance again if the data show signs of a resurgence of inflationary pressures.

Market and financial community reactions

Waller’s words sparked an immediate response in the financial markets. The major stock market indices, which had already been showing signs of optimism regarding the possibility of a more flexible monetary policy, registered significant increases following his remarks. The S&P 500 and the Nasdaq rose by 1.2% and 1.5%, respectively, in the first hours of today’s session. Treasury bonds, on the other hand, saw a slight drop in yields, reflecting the expectation that financing costs will be reduced in the short term.

Several economists and monetary policy experts have welcomed Waller’s stance, arguing that the Fed is acting proactively to avoid a prolonged recession. “It’s a clear signal that the Federal Reserve is attuned to the current challenges of the economy,” said Mark Zandi, chief economist at Moody’s Analytics. “With inflation under control, now is the time to focus on avoiding an economic contraction that could have serious consequences.”

Not everyone agrees, however. Some critics point out that inflation, while it has moderated, is still above the Fed’s 2% long-term target. These analysts believe cutting rates now could be premature and that the central bank should wait for inflation to move closer to target before easing policy. “The risk that the Fed moves too quickly is real,” said Diane Swonk, chief economist at KPMG. “There are still many uncertainties in the global economy, and a hasty move could complicate matters further.”

As the Federal Reserve approaches its next meeting, scheduled for late October, attention will be on whether other board members share Waller’s view. So far, Fed Chair Jerome Powell has taken a cautious line, stressing the need to be flexible and data-driven. But with inflation on the decline and signs that the economy may need additional stimulus, debates over the size and speed of future cuts are likely to intensify.

For Waller, the key will be to continue to closely monitor economic indicators and adjust accordingly. “There is no set answer,” he said in his speech. “But what we do know is that we have the tools to act quickly and decisively when necessary.”

The next month will be crucial in determining the course of monetary policy in the United States and whether the approach of Waller and others at the Fed will be adopted as the predominant strategy at a critical time for the global economy.